Tuvoc’s wealth management software development company offers bespoke software and application development for modern financial organizations that provide wealth management and advisory services. Get modules, features, and integrations designed for your business model, clientele, and operations. We provide unparalleled value with our customized approach and SOPs that help mitigate delays or cost overruns.

Connect with our experts.

We envision a model where our clients (wealth advisors, financial services, portfolio managers, and asset management companies) can interact with their clients on intuitive platforms built by our top-notch developers. By developing bespoke wealth management software, we ease the workflows of wealth management companies. Our services include the development of portfolio modeling algorithms, client risk profiling modules, multi-asset class tracking platforms, automated reporting dashboards, tax optimization tools, robo-advisors, and portfolio management solutions.

Hire our ExpertsDesign cutting-edge digital investment applications, such as an AI-powered Robo advisor that offers automated, algorithm-based financial advice. Our robo-advisory development services integrate features such as AI-driven portfolio allocation, auto-rebalancing, risk assessment algorithms, tax-loss harvesting, 24/7 market monitoring, ETF integrations, and more. Need emotion-free investing? Hire our robo advisory services.

We help you build robust portfolio management software that comes with features for AI-powered risk analytics, real-time performance tracking, multi-asset class integration, automated rebalancing tools, portfolio reshuffling tools, and more. Access the software through various portals designed for portfolio managers and clients. Both can view all portfolio stocks and assets, along with their performance, on intuitive dashboards.

Our wealth management software team can develop proactive financial planning tools for wealth advisory companies and their clients. These tools feature modules for cash flow analysis, tax optimization, retirement scenario analysis, education or miscellaneous funding estimators, insurance, and loan need calculators, among others.

Strengthen client connections with purpose-built CRM systems for wealth management firms that come with features for 360° client profiling, client segmentation tools based on their assets, client engagement tools, personalized offers, referrals, and more. Use the software to increase client satisfaction and onboard more HNIs.

Accelerate your business with our end-to-end advisory wealth management platforms that combine advisor dashboards, client-facing portals, and administrative tools in a unified software system. The software helps advisors streamline their work with inbuilt tools for digital client onboarding, personalized advisory services with AI assistance, automated portfolio construction, and behavioral finance analytics integration.

Does your wealth management firm need a compliant software to automate the computation of tax liabilities (across regions and countries) for global clients? We build sophisticated tax planning and management solutions that can do real-time tax liability analysis and also find ways to minimize it.

Build retirement planning tools with features for analyzing clients’ current income and expenditure, forecasting future income and expenditure, and then creating financial plans for retirement goals. It offers extensive analysis of income, expenses, life and annuity insurance, loans, investments, etc., to create optimal retirement investment plans.

Want AI competencies to power wealth management operations? Get integration of predictive analytics to detect risks, construct market-proof portfolios, and automate various tasks and client communication. Our AI-powered wealth management software and machine learning algorithms also generate personalized investment recommendations aligned with client preferences. We can also add ML-driven asset allocation features, AI-pattern recognition, and NLP-based market sentiment analysis features.

Our custom wealth management solutions blend cutting-edge technology with intuitive user experiences for advisors and clients.

Contact our team today

Build objective-oriented planning tools focused on delivering ROIs and meeting the specific goals of your clients. We design customized and fully interactive models for retirement, education, and legacy planning. Clients can explore different scenarios considering factors like inflation, market fluctuations, and evolving life situations.

Oversee multiple asset classes such as stocks, bonds, alternative investments, real estate, and cryptocurrencies using an integrated platform. Our solutions for wealth management companies provide them with the capabilities to manage diverse asset classes under one dashboard. From cross-asset correlation analysis to multi-currency price tracking, get all in one with a centralized platform.

For wealth management companies, investment management is the key workflow. We help them automate it with modules for algorithm-driven portfolio construction, automated adjusting of the portfolio to market conditions, and portfolio rebalancing as per the client’s changing needs and preferences.

Boost your client connections and strengthen HNI bonds with strategic, sophisticated, and feature-rich customer engagement modules with various self-service features, inbuilt support tools, and reporting features. Also, keep your regular clients informed of your latest plan launches, benefits, offers, and discounts.

From features for task prioritization and client risk profiling to AI-based client pitch preparation and cross-selling opportunity finder, our advisor productivity module is targeted to keep advisor productivity high while eliminating any roadblocks they face in dealing with clients.

Risk management tools manage risk, track portfolio risks, run stress tests, and give early warnings about market or operational threats. Follow regulatory rules by using tools that combine compliance systems. These systems include areas like KYC and AML rules checking, automated regulatory surveillance, and audit trail documentation.

Excel in your advisory business with purpose-built technology that eliminates challenges and 5X investor experiences.

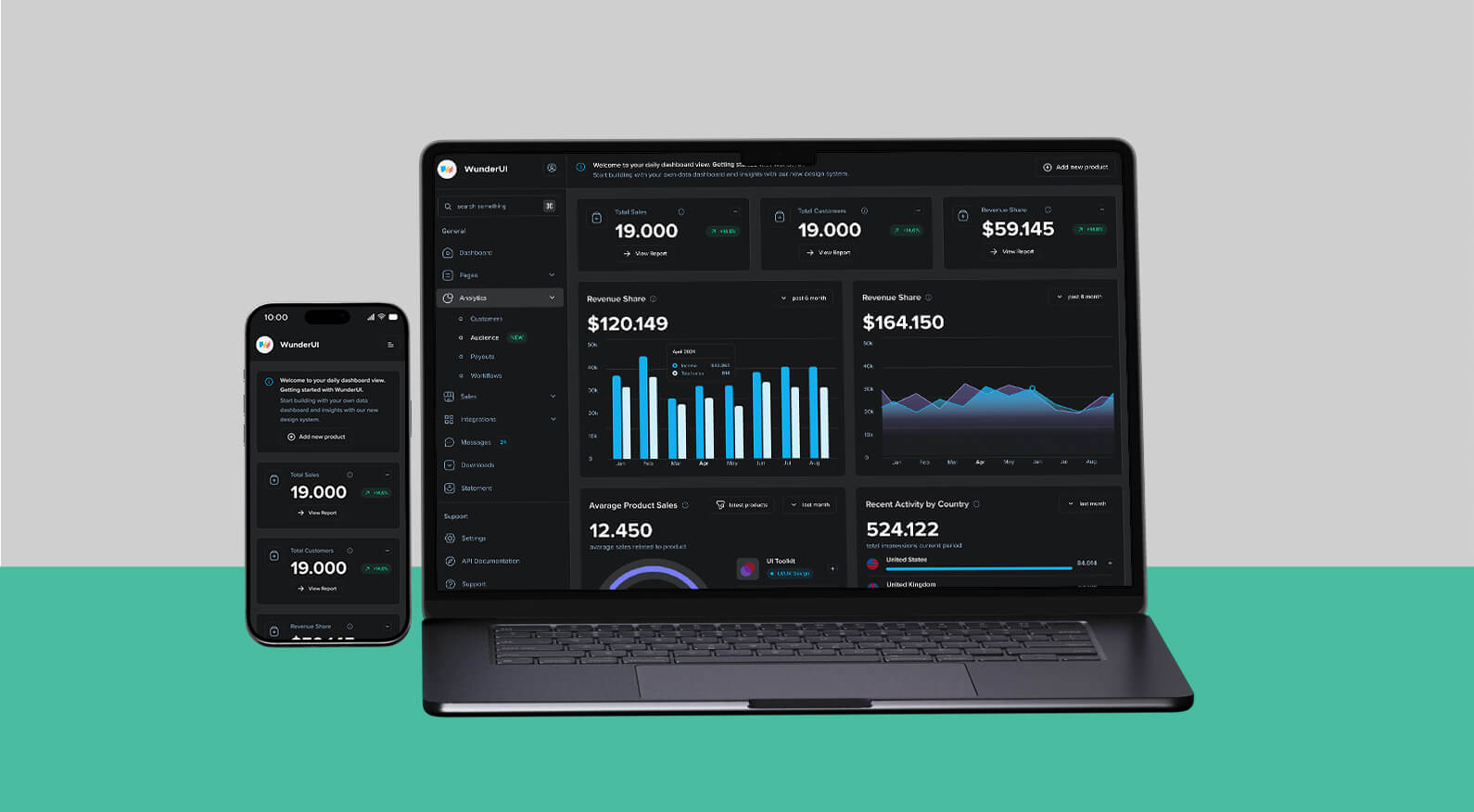

Deliver personalized wealth management experience to your clients with our software development expertise. Build intuitive client portals featuring interactive dashboards, goal visualization, and AI-powered insights to enrich client experience. Beautifully coded mobile-first interface and custom reporting boost CX by multiple times.

Our software development supports business expansion with a modular cloud-based infrastructure. Our apps or software are designed to scale without hiccups, and no matter how many clients you onboard in any season, the scalability is dependable. No performance lags or degradation.

Custom platforms that come with unique features, a value proposition, and exclusive modules as per your objectives help you create a competitive moat that beats your rivals. Our custom platforms reinforce brand identity through specialized expertise, superior outcomes, and robust capabilities.

Our wealth management software development helps advisory firms collaborate to improve their operational speed and reduce admin work. We provide wealth advisors with the tools, software solutions, and apps they need to handle various clients without facing workload woes.

Our wealth management software expertise assists investment management firms and asset managers in benefiting from data analytics. Smart dashboards, AI-powered data analytics, and prediction tools provide them with the competencies to serve their clients better and achieve higher ROIs for them.

We stay up-to-date with changing financial compliance rules and develop platforms that are fully-compliant with financial software regulatory requirements. We follow regulations such as GDPR, CCPA, etc., to eliminate any legal penalty scenario for our clients.

Increase the capabilities, features, and competencies of your wealth management software with powerful integrations with third-party apps and software.

Link your wealth management platform with top CRM platforms such as Salesforce, Microsoft Dynamics, Zoho, etc., to create a unified repository for client data, automated lead scoring, and multi-channel client support tools.

Seamlessly integrate with dedicated third-party financial planning applications such as budgeting apps, retirement calculators, loan & debt calculators, net worth estimators, and tax assistance tools.

Access real-time financial information and real-time pricing through integrations with quality financial publications like Reuters, S&P Global, Bloomberg, Yahoo Finance, CNBC, and other market data services.

Create direct links with leading custodians, including Charles Schwab, JP Morgan, Fidelity, Northern Trust, and Interactive Brokers, for automated account setup, position reconciliation, and trade processing.

Integrate your wealth management platform with document management systems such as DocuSign, OneDrive, Google Drive, Box, and SharePoint to process paperwork and maintain compliant record-keeping.

Connect with accounting platforms like QuickBooks, Xero, and Sage to synchronize financial data and establish centralized accounting. Get custom bookkeeping for your HNI clients.

Behind every project is a business challenge solved and measurable results delivered. Explore how our custom software solutions have transformed operations and created competitive advantages for our clients.

Increase in productivity

Return on investment

Countries Served

5-star reviews

Build client trust and eliminate any penal scenarios for your clients with wealth management software development that meets strict regulatory standards.

Incorporate Securities and Exchange Commission requirements for investment advisor platforms and keep your software aligned with SEC guidelines.

We ensure adherence to Financial Industry Regulatory Authority standards for broker-dealers with automated suitability checks and compliant communication.

Our software development for wealth management companies enforces General Data Protection Regulation measures for European clientele.

We maintain Payment Card Industry Data Security Standards for wealth advisory platforms that also process financial transactions.

Our development methods align with Service Organization Control 2 standards. SOC 2 compliance ensures security, availability, confidentiality, and privacy.

For platforms catering to California residents, we implement California Consumer Privacy Act safeguards.

Exceed client expectations and drive wealth advisory business with next-gen technologies. Surpass your competitors with wealth management software built for the pros.

We employ artificial intelligence and machine learning to create avenues for personalized investment advice or automate portfolio creation using AI’s power to analyze market sentiments and company profiles. AI in wealth management software also expedites pattern recognition and predicting market moves.

Our wealth management platforms are built with the most scalable architecture–the cloud native ones. The cloud technology ensures that all wealth management software we develop is optimal, scalable, dependable, and secure. We have experts in multi-cloud implementation and serverless computing.

Integrating advanced data analytics into our platforms helps advisors and their clients visualize complex financials as easy patterns and intuitive charts. From predictive analytics to scenario analysis, using data analytics tech boosts accurate decision-making.

Integrating blockchain in wealth management software helps create immutable transaction records, smart contracts, and unchangeable audit trails. It improves the security of wealth advisory apps by introducing cryptographic security features and tokenization capabilities.

Our wealth management solutions can implement the power of Natural Language Processing to transform how clients interact with advisory services. NLP can be deployed to study market sentiments from social media, discussion forums, and top financial publications.

Wealth management platforms need added security layers owing to the enormous financial risk. We add cutting-edge security measures, including multi-factor biometric authentication through fingerprint, facial recognition, and voice verification.

Tuvoc helps in developing custom wealth management software with innovative features through a meticulous client-centric process that starts at onboarding and continues post-deployment with ongoing compliance monitoring.

We analyze your wealth management challenges, client pain points, portfolio management issues, and current system gaps. Based on it, we map requirements and define project goals for an efficient solution.

We design your solution keeping in mind regulatory compliance and user experience. We provide wireframes, architecture, and a detailed roadmap. Once approved, we move to the development phase.

We leverage top methodologies, frameworks, and tech stacks to build your wealth management software. QA, security, and rigorous testing are integral to ensure a high-performing solution.

We deliver your fully functional wealth management software with team training and continuous support for system performance, security, and regulatory compliance.

Accelerate innovation, unlock growth, and drive impact across financial domains with our custom financial software solutions.

At Tuvoc, we specialize in designing highly secure and performance-optimized financial portals that provide a seamless experience across various devices, including desktops, tablets, and smartphones.

We build robust financial applications for both iOS and Android platforms. Our native mobile app development expertise comes in handy in building super-performance native apps for finance companies.

Our financial Progressive Web Apps (PWAs) merge the best aspects of web and mobile applications. Our financial apps load swiftly even under poor network conditions.

We ensure seamless integration of your enterprise applications with core banking systems, CRM platforms, and external financial services through secure API gateways.

As an experienced custom software development company, our developers possess an in-depth understanding of diverse technological stacks to provide comprehensive enterprise apps.

We deliver customized wealth management technology solutions for various wealth management business models and firms. Global businesses choose us for our profound industry knowledge and development expertise.

Our wealth management software development team combines deep financial industry knowledge with technical expertise. From regulatory compliance and market sector analysis to risk assessment and tax optimization strategies, our financial software development veterans deliver solutions that meet the nuanced demands of wealth management workflows and client expectations.

Wealth advisories across the globe choose Tuvoc owing to the feature-rich development we provide. Adding to it are our smart integration capabilities. We integrate seamlessly with multiple third-party platforms, APIs, and global tech to provide more competencies to our clients.

Clients get impressed with our user-centricity. We develop highly intuitive interfaces that are easier for advisors, investors, and admins, too. We go for extensive user testing to refine our UI/UX for optimal experiences. Hiring Tuvoc for wealth management software ensures the best UI/UX in the industry.

To protect sensitive financial data, we implement robust security measures such as encryption, access controls, audit logging, and vulnerability assessments. Our security protocols are aligned with financial and wealth management industry standards. Compliance automation, zero-trust security, and regular vulnerability scanning are inseparable parts of our security practices.

Our wealth management software development follows agile practices that prioritize collaboration, transparency, and adaptability. Through iterative development cycles with cross-functional teams, we deliver functional increments at regular intervals. We have one of the fastest to the market rate.

We build lasting relationships beyond initial implementation, providing continuous enhancement for all the wealth management software that we build for our clients. Our support ensures your platform evolves with changing business needs.

The development expenses for a custom wealth management platform are between $50,000 to over $500,000. The features, modules, add–ons, and integrations influence the costs. Extensive wealth management platform development may start at $200,000 and extend beyond $700,000 owing to embedded analytics, compliance requirements, adherence, and more.

Key features for a standard wealth management software include:

Developing digital wealth management solutions with complete features and proper integrations takes between 3 and 12 months. Everything depends on the scale, complexity, implementation type, and features required. Simpler platforms with basic features might be developed within 6-8 months. However, more sophisticated solutions that demand extensive customization and integration could require 12 to 15 months or even longer. We employ an agile development strategy to expedite the project outcomes.

Choosing between custom development and an off-the-shelf solution involves several considerations:

Opt for custom development if:

Stay updated with articles that share practical tips, industry news, and thoughtful commentary on digital trends.